Keep Your W-9 Information Up to Date in Fuel Me

You will need to provide your current W-9 form to Fuel Me in order to place orders through the portal. Fuel Me must collect this information for tax-related purposes. You can easily upload and store these important tax details from within your Fuel Me account. If you have any questions regarding the W-9 requirement, please reach out directly to your Account Manager.

The W-9 form is an official document used in the United States by businesses to request the taxpayer identification number (TIN) and legal name of individuals or entities. It is primarily used for reporting payments made to vendors or independent contractors to the Internal Revenue Service (IRS).

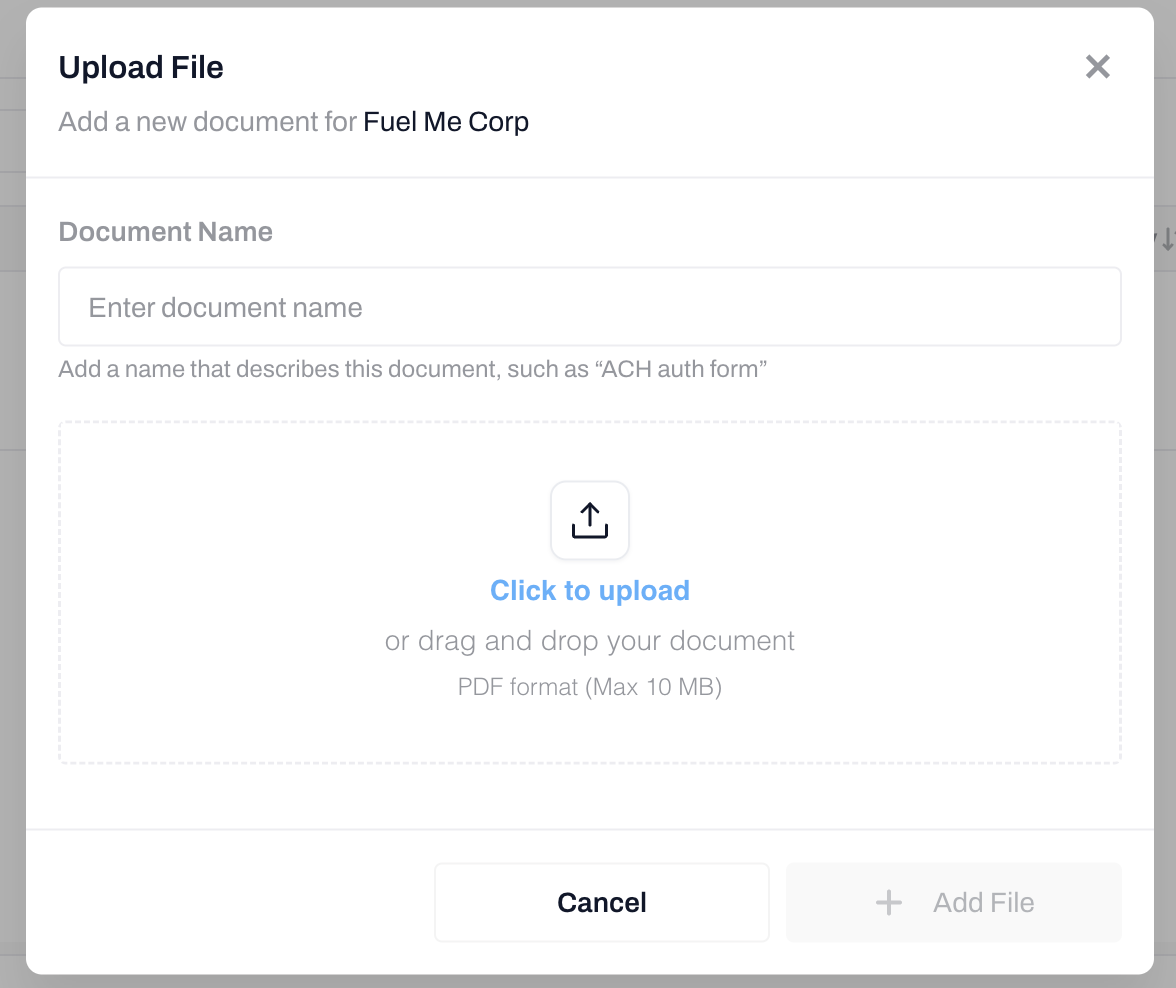

Add Your W-9

To upload your W-9, navigate to 'Files' in the main sidebar menu, then click on the 'Files' tab, then click on + Upload File. Then either drag and drop or upload your PDF file into the pop-up window and click the '+ Add File' button.

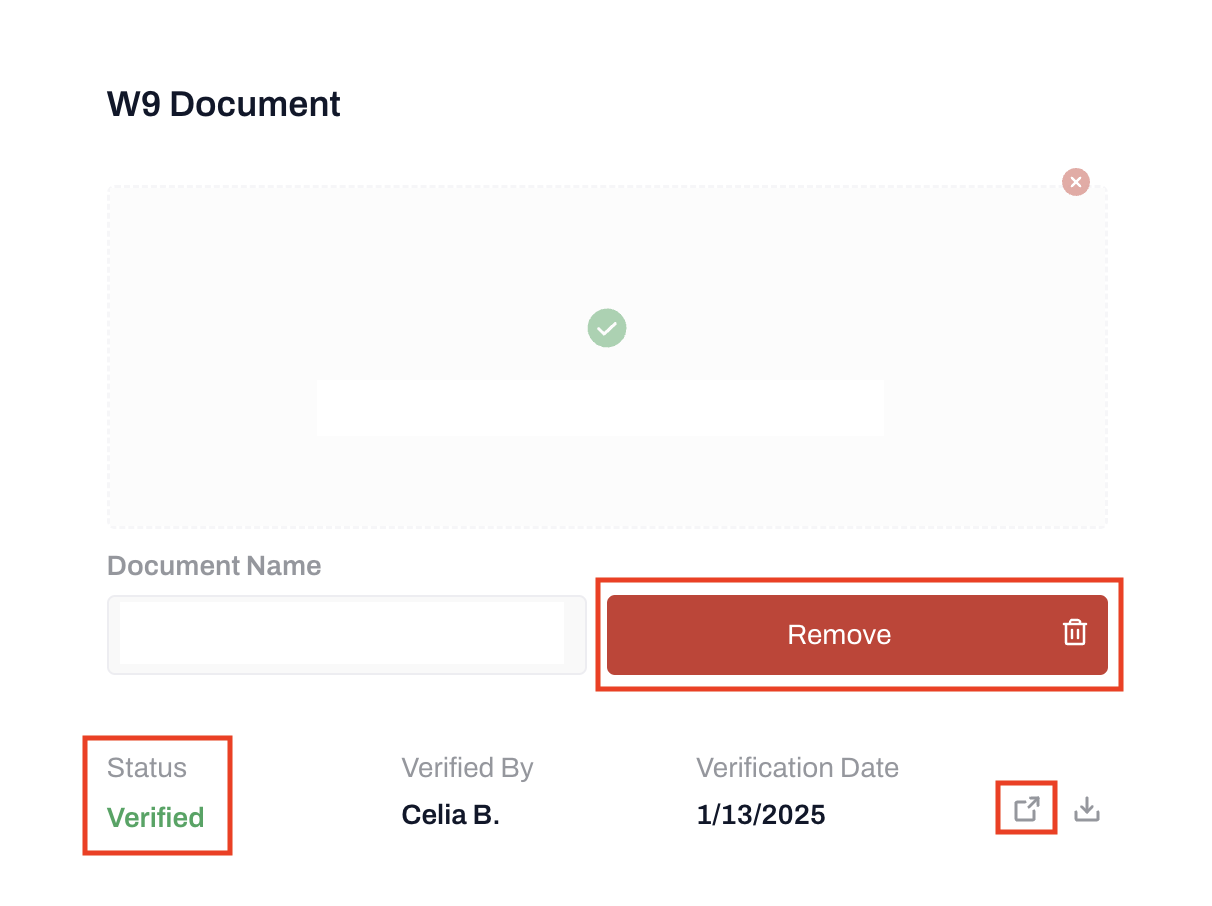

Viewing Your W-9

Once your W9 has been uploaded, your Account Manager will be prompted to verify the document.

You will be notified by Fuel Me once your W-9 has been confirmed and verified.

You can also view the status of your W9 by navigating to 'Files' in the main sidebar menu and then clicking on the W9 tab.

This tab will display the W9's status, allow you to remove the current document, and view the document from within your Fuel Me Account.

-2.png?height=120&name=Wordmark%20(White)-2.png)